Email: | RKSV Commodities MCX Member Code: 46510 | SEBI Regn. Now that we have talked about the pitfalls, we will be exploring some ideas of using the averages for our trading!

:max_bytes(150000):strip_icc()/dotdash_INV_final-Double-Exponential-Moving-Averages-Explained_Feb_2021-02-1722c880c7384677b1043fc19f01b642.jpg)

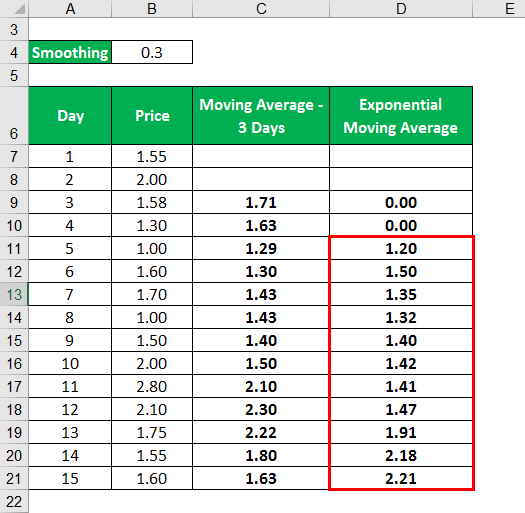

Login to Nest and select the scrip you want, we are looking at BankNifty here.Discipline and methodology are your main ingredients to successful trading. Please make sure you are not leveraging too much by risking no more than 0.5% or 1% per trade for beginners and slightly more for the more experienced.Īt the end of the day you are basically looking at the average movement of price, use a tested methodology to trade the averages. Unfortunately, a lot of traders concentrate too much time on price discovery methods and not as much time on their risk management. The averages work well as a confirmatory indicator rather than a leading indicator. It is vital to use averages with strong price action methodologies which have shown results independently. The key points to remember when using the moving averages are: The EMAs and SMAs are not efficient indicators, they provide a way to check what the masses are looking at and may give us an indication for trend changes. The same way a 20 day EMA will give about 9.5% weightage to the most recent data. That means a 10 day EMA gives 18.8% weightage to the most recent data. The most important factor is the smoothing constant that = 2/(1+N) where N = the number of days.įor example the smoothening for a 10-day EMA = 2/( 10+1) = 18.8 How the EMA is calculatedĬurrent EMA= ((Price(current) – previous EMA)) X multiplier) + previous EMA. Thus, the EMA was born, it gave more importance to recent data and the most popular variant is called the Exponential Moving Average (EMA). Traders started to argue that the most recent development has the right to influence our averages more than the older data points. Many traders asked themselves why older price points were given the same weightage as new price points in the simple moving average. Now, If you think about it the simple moving averages gives the same ‘weight’ or importance to each new data point equally. For instance intraday traders may look to buy the cross over of the 10 period and 20 period average on the 10 20min timeframe while the investor may look for some buying pressure to arise at the touch of the 200 MA on the daily charts. The moving average is not restricted to only daily charts, they can be used on any timeframe and are useful for intraday traders as well as investors simply by changing the timeframe. If you were wondering why we call this a “moving” average and not just mean of prices it is because as new days are added, previous data sets are dropped to include the new data and the average is constantly ‘moving’. When a new day is added then we have 2 points, and the calculation is done every time a new data set arises, eventually making a blue line you see in the charts above. This of course gives us a single average point. To calculate a 21 day simple moving average, simply add the closing prices of the last 21 days and divide by 21.

#Exponential moving average formula how to#

Lucky you? How To Calculate a Simple Moving Average

#Exponential moving average formula software#

Today with the advantage of technology our customers at Upstox can use their NEST trading software and obtain a chart with their desired moving average within a few clicks (shown at the end of this article). After they had enough data they would draw a line to ‘average’ the movement of the stock over a certain number of days. In the times before us traders used to plot a chart by hand, taking each day’s closing price and recording it in a diary. You live in much easier times than the generation of traders before us. *By signing up you agree to our Terms and Conditions The Simple Moving Average

0 kommentar(er)

0 kommentar(er)